Renting a flat on a business trip is increasingly replacing a hotel - especially when privacy, work space and a location close to the centre are important. At the same time, business trips raise recurring questions for accounting departments: what data should be on the document, can the company be invoiced, how to describe the service and what about VAT. Below, we have collected the most common doubts and practical tips to help you settle your stay in Wrocław smoothly.

Flat rentals on the Oder River and accounting for business trips - what accounting usually checks

In the case of a business stay, it is most important that the sales document clearly confirms the purchase of the accommodation service (accommodation) and identifies the purchaser. Accounting usually verifies:

- that the invoice has been issued to the correct company details (name, address, VAT ID),

- that the date of service (date of stay) is correct,

- whether the name of the service on the invoice corresponds to the accommodation/accommodation,

- that the amounts and currency are consistent with the booking arrangements,

- whether the seller and the place of issue are indicated.

Logistical convenience can also be important when travelling to Wrocław - a flat in the city centre reduces the cost of travelling to meetings, conferences or the offices of business partners, while also making it easier to maintain a work rhythm.

Flats in the centre of Wrocław for business stays - why this is a practical solution

On business trips, it is not only the accommodation itself that counts, but also the conditions for work and rest. Flats in the centre of Wrocław are sometimes chosen by managers, entrepreneurs and VIP guests for their independence, larger space than a standard hotel room and the possibility to use the living area and kitchen. In practice, this means more convenient organisation of the day - from morning work at the table, through meetings in the city, to evening regeneration in a quiet space.

Flexibility is also important for companies: the stay can be for one person, several colleagues or guests coming for negotiations or industry events. In such situations, the following are well suited flats for companieswhere a clear booking process and structured documentation for billing is a priority.

Information about the facility: comfort and prestigious location on the Oder River

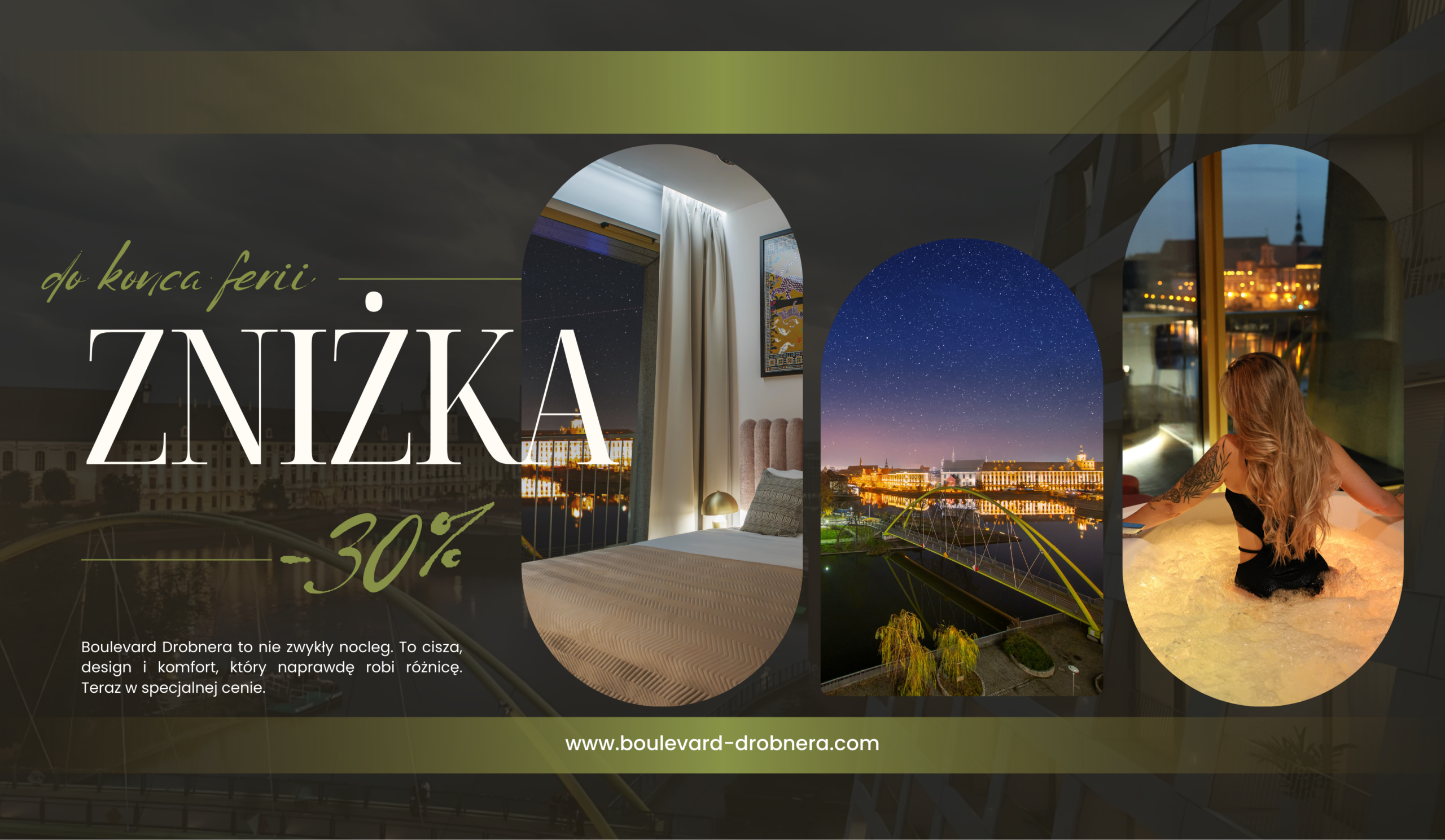

Wrocław's suites on the Oder River in the Boulevard Drobnera building are distinguished by their location close to the key points of the city centre - an advantage both for those travelling for conferences and for meetings in offices located in the city centre. The proximity of the river is also conducive to short walks after a busy day, which is appreciated by guests focused on efficiency and regeneration.

The flats themselves rely on modern interiors and practical furnishings: a comfortable space to relax, a place to work and amenities that facilitate a longer stay. In this way, renting for a stay in Wrocław can be a solution not just for "overnight stays", but a viable base during a business trip of several days.

How to prepare invoice data to avoid corrections

The most common reason for subsequent corrections is the lack of complete purchaser data or errors in the TIN. To streamline the settlement, it is best to prepare and transmit before the document is issued:

- the full name of the company (according to the register),

- registered address,

- NIP (for Polish entities),

- whether the purchaser is a company or an individual,

- the preferred method of service of the document (e.g. e-mail).

In the case of foreign guests, it may also be useful to clarify the billing details required by the organisation (e.g. PO number, cost centre) - if the company's accounting system requires this.

Frequently asked questions: invoice for flat rentals on business trips

The following answers sort out the typical concerns of finance departments when booking a flat in the city centre, including in the context of search phrases such as "flat rental on the Oder" or "flats Wrocław Boulevard Drobnera".

The combination of convenient location, comfort and tidy paperwork means that renting flats on the Oder can be a smooth part of your business trip, so it's best to make your booking directly on the https://boulevard-drobnera.com/pl/.

FAQ

- Is it possible to receive an invoice for the company for the stay in the flat?

Yes - as standard, it is possible to issue an invoice to a company provided the correct details of the buyer (name, address, VAT ID) are provided before the document is issued. - Which service should the invoice describe: 'overnight stay' or 'flat rental'?

Accounting most often expects an unambiguous description of the accommodation/night stay service with the date range of the stay. It is most important that the description corresponds to the actual service and is consistent with the booking. - Must the names of all guests be indicated on the invoice?

This is not normally required for accounting purposes. The key information is the details of the seller, the buyer and the parameters of the service (term, value). If the company has internal procedures, it may ask for additional information in the description or attachment. - Does the invoice date have to coincide with the date of stay?

Not always. It is essential that the period of service (dates of stay) is included on the document and that the document is issued in accordance with regulations and billing practice. If necessary, accounting will usually verify both fields: the date of issue and the date of service. - Can costs be split - e.g. accommodation and parking separately?

If there are separately billable elements within the stay, accounting often asks for these to be specified. It is a good idea to establish this at the booking stage so that the document is clear and in line with the company's billing needs. - What should I do if there is an error in the invoice data?

The need for correction should be reported as soon as possible and the correct data should be provided. The most common corrections are: TIN, address, company name or typos in the purchaser's data. - Can an invoice be sent by e-mail?

In business practice, electronic invoices are commonplace. It is worth indicating the correct email address to the accounting department already at the time of booking to avoid delays in the settlement of the delegation.

Bibliography

- Act of 11 March 2004 on tax on goods and services (VAT) - Dz.U. 2004 No. 54 item 535 as amended.

- Act of 29 September 1994 on accounting - Dz.U. 1994 No. 121 item 591, as amended.

- Act of 26 July 1991 on personal income tax (PIT) - Dz.U. 1991 No. 80 item 350 as amended.

- Act of 15 February 1992 on corporate income tax (CIT) - Dz.U. 1992 no. 21 item 86 as amended.