A business trip to Wrocław often starts with a simple question: how to book company accommodation so as not to waste time later on correcting invoice details, clarifying costs or collecting documents to settle the business trip. With short-term rentals, details count - especially when the stay involves several people, variable dates or the need for discretion. Below is a practical list of data and documents you should prepare before booking to ensure that the whole process goes smoothly.

Renting flats along the Oder River for business - why paperwork is important

Business decision-makers are choosing flats in the centre of Wroclaw not only because of its location, but also because of its organisational predictability. Well-collected company data speeds up the issuing of accounting documents, facilitates the settlement of stay costs and minimises the risk of invoice corrections. This is especially important for recurring business trips, project team stays and VIP guest visits.

In practice, the preparation of a complete set of information prior to booking shortens correspondence, organises arrangements (e.g. who lives in the flat, who pays, what details are to be invoiced for VAT) and allows the standard and layout of the flat to be matched to the needs of the stay right away.

What company details are needed for the booking (VAT invoice, VAT ID, address)

More often than not, it is useful to provide the details that will go on the VAT invoice already at the booking stage. Here is a set of information to improve the service:

- Full name of the company (in accordance with the CEIDG/KRS register).

- NIP - key to the correct issuing of a VAT invoice.

- Headquarters address (street, number, code, city, country).

- Contact details of the person making the booking - name, telephone, e-mail.

- Payer information - whether the company or an individual pays (e.g. an employee and then there is a re-invoicing).

- Invoice requirements - e.g. project name/designation, OP number, MPK or other internal cost designations (if used by the organisation).

In the case of foreign companies, it is a good idea to indicate the country of tax residence and the identification data used for billing (e.g. EU VAT number, if applicable) right away. This allows a quicker assessment of how the document was issued and reduces subsequent clarification.

Documents and confirmations for a company stay - what to have on hand

Business-standard rentals usually do not require complex documentation, but in practice they come in handy:

- Booking confirmation with the scope of your stay (dates, number of persons, selected flat, terms of payment).

- Data of accommodated persons - Name, time of arrival if necessary (facilitates the logistics of handing over information on key collection).

- Identity document guest to verify identity, if required in the service process.

- Payment arrangements - pro forma, prepayment, payment on site or transfer after the stay (depending on the rules).

For team stays, it is advisable to prepare a simple list: who lives in which flat and whether the invoice should cover the whole or be split into several documents.

Accounting for business trips and overnight expenses - how to prepare in accounting terms

From the perspective of the administration or accounting department, the most important thing is that the sales document is issued with the correct data and covers the agreed scope of service. It is good practice to establish before the stay:

- For which data the VAT invoice is to be - company or individual.

- Is cost sharing needed - e.g. accommodation and ancillary services (if any) under separate headings.

- Invoice date - immediately upon payment, at the end of the stay or as agreed.

- Method of document delivery - e-mail (PDF) or paper version if required.

With short business stays, speed is of the essence: the fewer corrections and clarifications, the more smoothly a business trip closes. This is particularly important when the stay involves several employees or external guests and the settlement of costs requires consistent documentation.

Flats on the Oder River in the centre of Wrocław - comfort, privacy and location

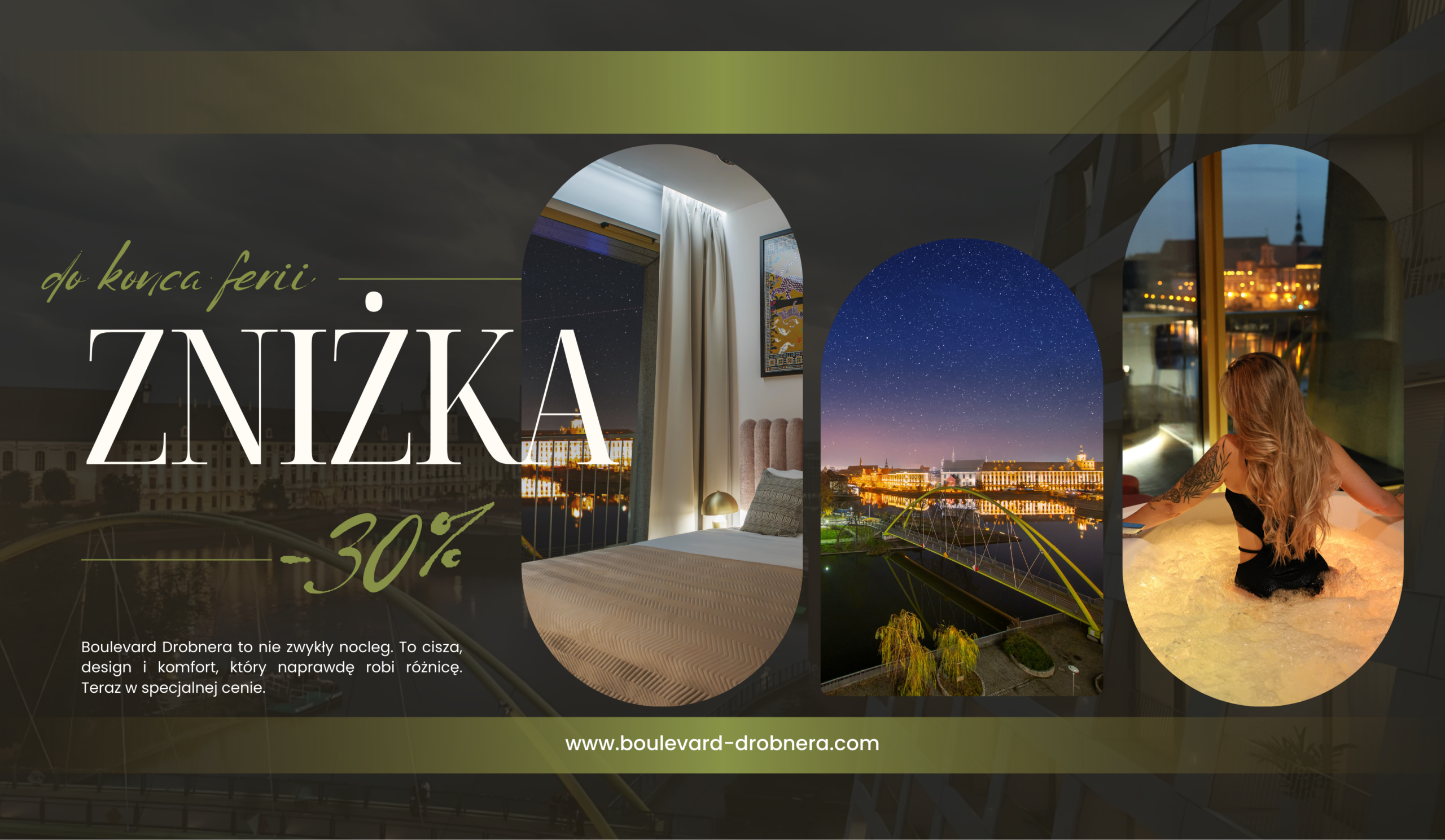

The modern Boulevard Drobnera building is distinguished by its prestigious location on the Oder River and convenient access to key points in the city. Such a location is conducive to business meetings in the centre and quick access to office buildings and industry events. An additional advantage is the comfort of the stay - the flats value space, privacy and the possibility to work in a peaceful environment.

The flats in the centre of Wrocław are prepared for short-term and medium-term stays. The standard expected by business guests includes functional interiors, comfortable living areas and facilities that support daily organisation - from storing belongings to the ability to prepare meals on one's own. Offer flats for companies allows you to fit your stay into your schedule for meetings, business trips and project trips.

What to consider when making a reservation: number of people, dates, needs of the stay

In order to ensure that the rental of flats on the Oder River is tailored to your real needs, it is useful to gather key information before you send your enquiry:

- Number of visitors and preferred sleeping arrangements (e.g. double bed vs. two singles).

- Length of stay - 1-2 nights, one week, project stay.

- Priorities - silence, view, quick access to the centre, privacy.

- Arrival and departure times - particularly important with a busy meeting schedule.

- Organisational needs - e.g. permanent contact of one person, cyclical bookings, recurring standard.

Wrocław after the meetings: attractions nearby for a short evening

After a day of business talks, take advantage of the location benefits offered by the Oder River Apartments. There are places nearby that are ideal for a short walk or dinner:

- Market square and surroundings - a large selection of restaurants and spaces for meeting in a less formal atmosphere.

- Ostrów Tumski - A quiet route for an evening walk, particularly attractive after dark.

- Nadodrze - district with atmospheric cafés and studios.

Those planning a stay for a specific date can additionally check the current calendar of events (concerts, trade fairs, conferences) at venues such as the Centennial Hall or the National Forum of Music - this allows you to better plan your commute and free time.

In order to efficiently prepare a company booking and quickly receive a set of documents for settlement, it is most convenient to provide the company's details and the date of the stay right at the start and proceed to finalisation through the site https://boulevard-drobnera.com/pl/.

FAQ - Corporate booking, VAT invoice and settlement of stay

1. What data is required for a VAT invoice for an overnight stay?

Most often, the full name of the company, VAT number and registered office address are needed. In addition, an e-mail to send the invoice and the details of a contact person are useful.

(2) Can the TIN be provided after booking?

It is best to provide VAT and company details at the time of booking - this reduces the risk of mistakes and speeds up the preparation of the invoice. If the details change after the booking, it is worth notifying us as soon as possible. Please note that in the case of a receipt, as a rule an invoice for a receipt is only issued if the buyer's TIN is included on the receipt.

3. How to prepare for the settlement of an employee's delegation?

It is a good idea to ensure that you have a booking confirmation and a VAT invoice with the correct details. It is also good practice to establish in advance whether the document should go to an employee or directly to the accounting department.

4 Is it possible to invoice a foreign company?

Usually yes, but additional identification data (e.g. EU VAT number) and country of residence information may be needed. It is best to prepare this data in advance.

5. what is worth establishing when booking for several people from one company?

The key points are the guest list, the breakdown by flat and whether there is to be one summary invoice or several documents. This helps to avoid billing corrections.

6 What information speeds up the handling of company bookings?

In addition to the invoice details, it is expedited by: preferred times of arrival, length of stay, number of people and indication of the decision-maker for confirmations and changes.

Bibliography

- Act of 11 March 2004 on tax on goods and services (VAT) - Dz.U. 2004 No. 54 item 535 as amended.

- Act of 6 March 2018. - Entrepreneurs' Law - Dz.U. 2018 item 646 as amended.